- PlatformCreate exceptional embedded finance and payment experiences with Powens.

- SolutionsLearn more about the use cases and business activities we serve.

- About usWe’re building Europe’s number one Open Finance platform.

- Demo

- English

Automated Financial Categorization for Accurate Data Analysis

Our financial categorization solution enables businesses to efficiently analyze transaction data. Using artificial intelligence, we automatically classify income and expenses, providing a clear view of user financial habits and facilitating informed decision-making.

New services for end users

Our advanced categorization algorithms make it possible to deliver innovative and personalized financial services, tailored to meet the specific needs of every end user.

Stronger Customer Engagement

By offering a centralized view of spending patterns and financial habits, you can enhance customer engagement and build long-lasting loyalty.

The Ultimate Hub for Financial Insights

Transform your app into the go-to destination for organized financial data and insights, making it your customers’ ultimate financial management tool.

Discover Categorize

-

Data Collection and Cleansing

Gather and refine raw banking data to ensure accuracy and usability.

-

Data Transformation and Classification

Convert raw data into structured, meaningful categories for easy interpretation.

-

Analysis and Interpretation

Dive deep into the insights, unlocking valuable information from organized data.

-

Classify Raw Banking Data and Access Clear Insights

Easily classify raw banking data and access it seamlessly for enhanced financial insights.

Achieve 95% Accuracy: Consistently surpass market standards with highly precise data classification.

Evolving Intelligence: Trained on millions of transactions and continuously improving for better results.

Comprehensive Categorization: Classify bank statements into 115 distinct categories for detailed analysis.

Customizable Filters: Use ad-hoc filters tailored to your specific needs for refined data insights.

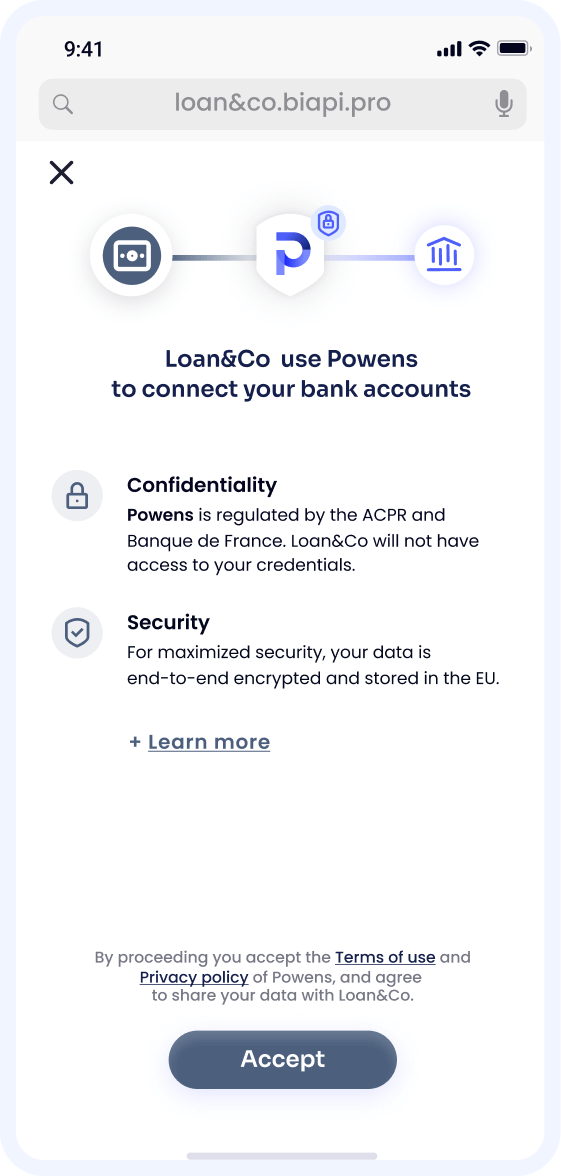

How Users Connect Their Accounts to Your Apps

We make the process simple and seamless, ensuring all user accounts are easy to connect and consistently available.

Webview link URL

https://walleto.biapi.pro/2.0/auth/webview/fr/connect/security?s=eyJjbGllb

1

Security & consent

We guide your users step by step, building trust and ensuring they provide their consent with confidence and peace of mind.

2

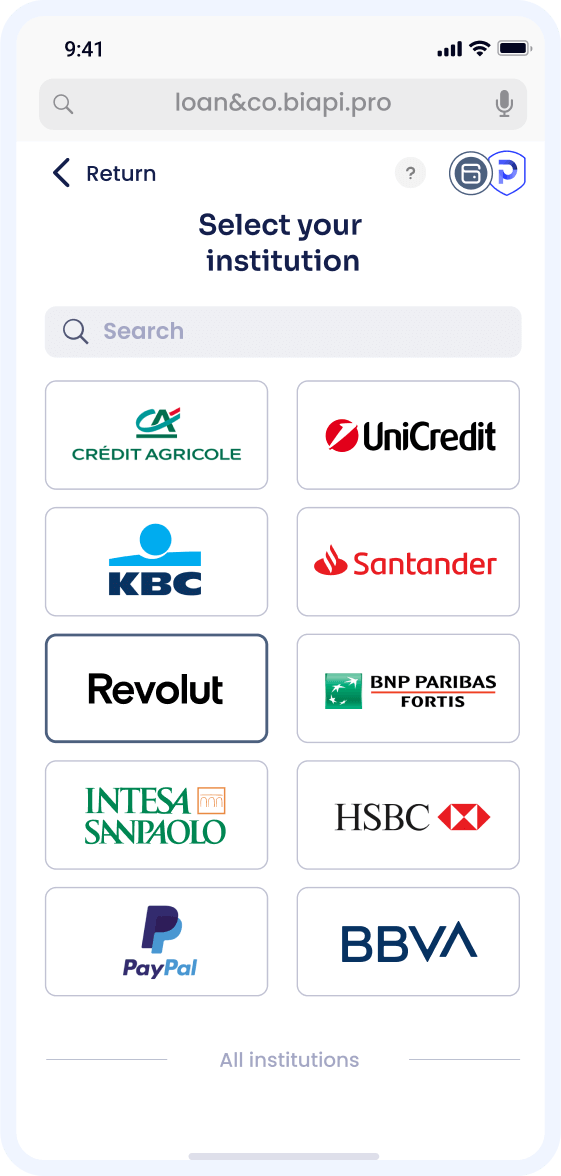

Selecting institutions

Users can easily find the right institution with our intuitive design. Popular options are highlighted, and a lightning-fast search ensures a seamless experience.

3

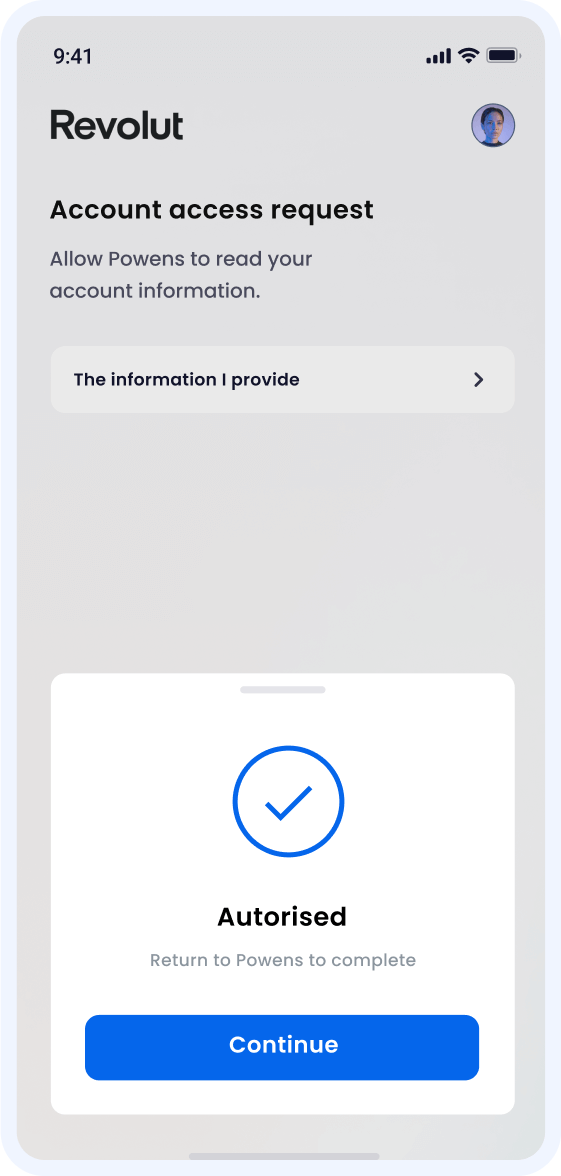

Authentication

Users can securely log in by entering their credentials directly into the Unnax webview, eliminating the need for redirection.

4

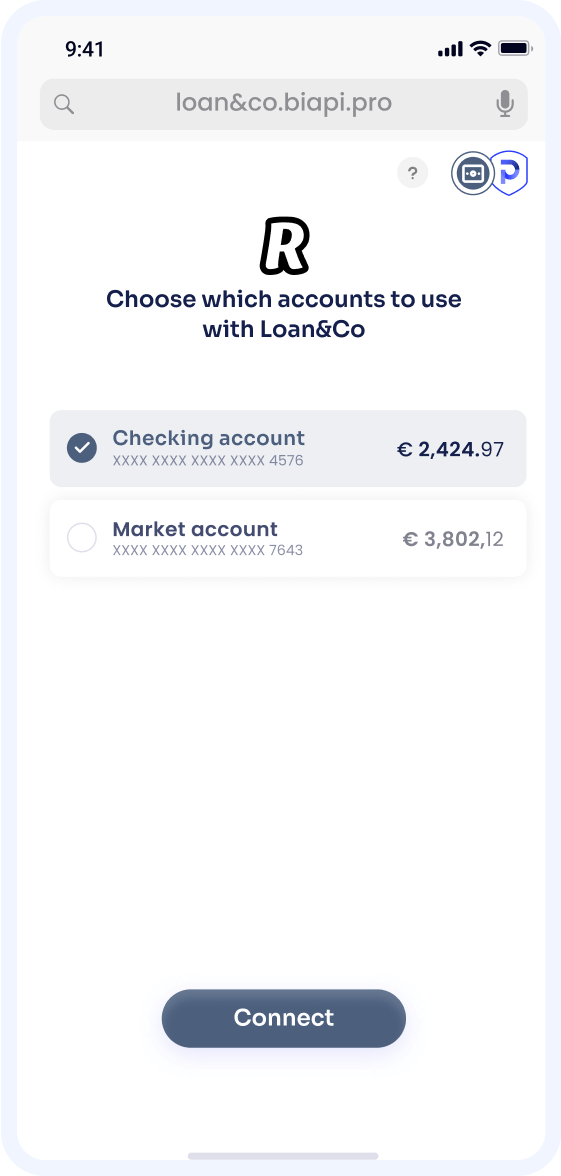

Account selection

Users have full control to choose only the bank accounts they wish to share, ensuring a consent process that is transparent and fully GDPR-compliant.

5

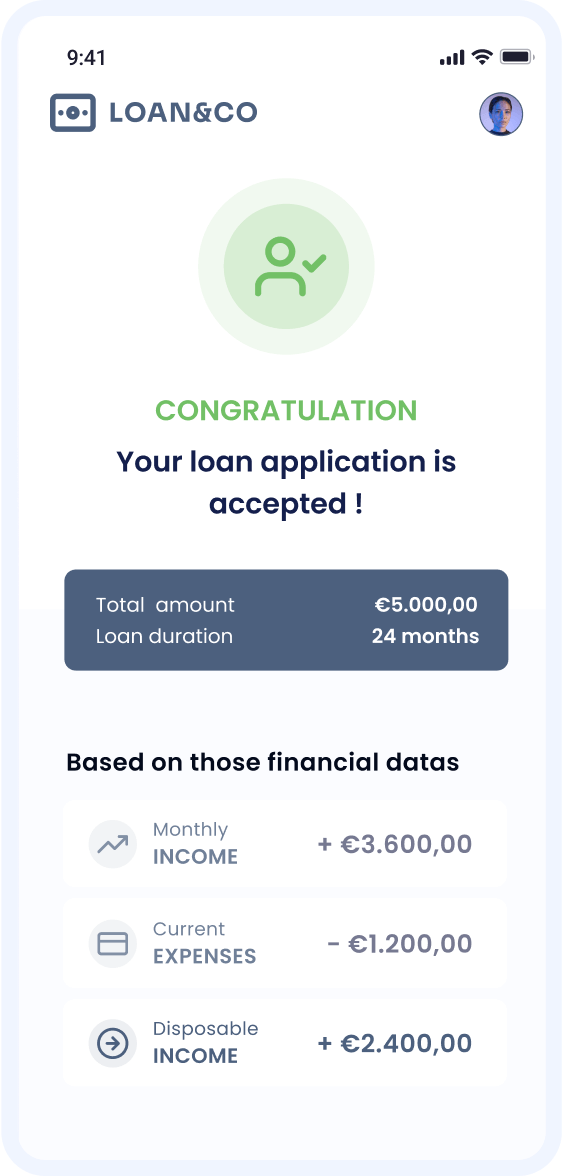

That’s it

The user is seamlessly redirected back to your app or website, with transactions, balances, and detailed portfolios instantly retrieved for immediate use.

Console

Easily configure your domains, client applications, webhooks, and connectors. Get full visibility into connection statuses.

Create an account and get started

Set up a free sandbox in just a few clicks and use the guided wizard to test our API with real-world scenarios.

Configure

Customize the user flow to increase success rates. Select the features and banks you want to activate.

Monitor

Track back synchronization usage and monitor health status reports.

Analyze

View key metrics and trends to enhance your Open Finance experience (transaction amounts, users, conversion rates, etc.).